[vc_row css_animation=”” row_type=”row” use_row_as_full_screen_section=”no” type=”full_width” angled_section=”no” text_align=”left” background_image_as_pattern=”without_pattern”][vc_column][vc_column_text]

Posted By [post_author]

A bird in the hand is better than two in the bush. Today’s labor market has turned this proverb around and it has Jay Powell’s attention.

The financial markets have been in turmoil as the Federal Reserve has struggled to control inflation. The US central bank has acknowledged their initial error of judging inflation as “transitory” largely due to pandemic induced supply chain disruptions. While many of these issues are resolving, core inflation measurements have remained persistently elevated.

A major concern for policymakers has been the imbalance between labor supply and demand. But how are employment and inflation related? This month’s update will focus on a few of the employment trends and their contributions to the Fed’s challenge of containing inflation.

The Threat of a Wage Price Spiral

At his May 2022 press conference, Federal Reserve chairman Jay Powell stated, “Wages are rising at the fastest pace in many years… We can’t allow a wage-price spiral to happen.” Intuitively higher wages would seem to be a positive for US consumers. A wage price spiral can lead to lasting inflation through two mechanisms, creating a feedback loop between them.

- Companies of all sizes raise the prices of goods and services to protect margins against rising labor costs.

- As workers’ income grows so does demand for finite goods and services which will also lead to higher inflation as prices increase.

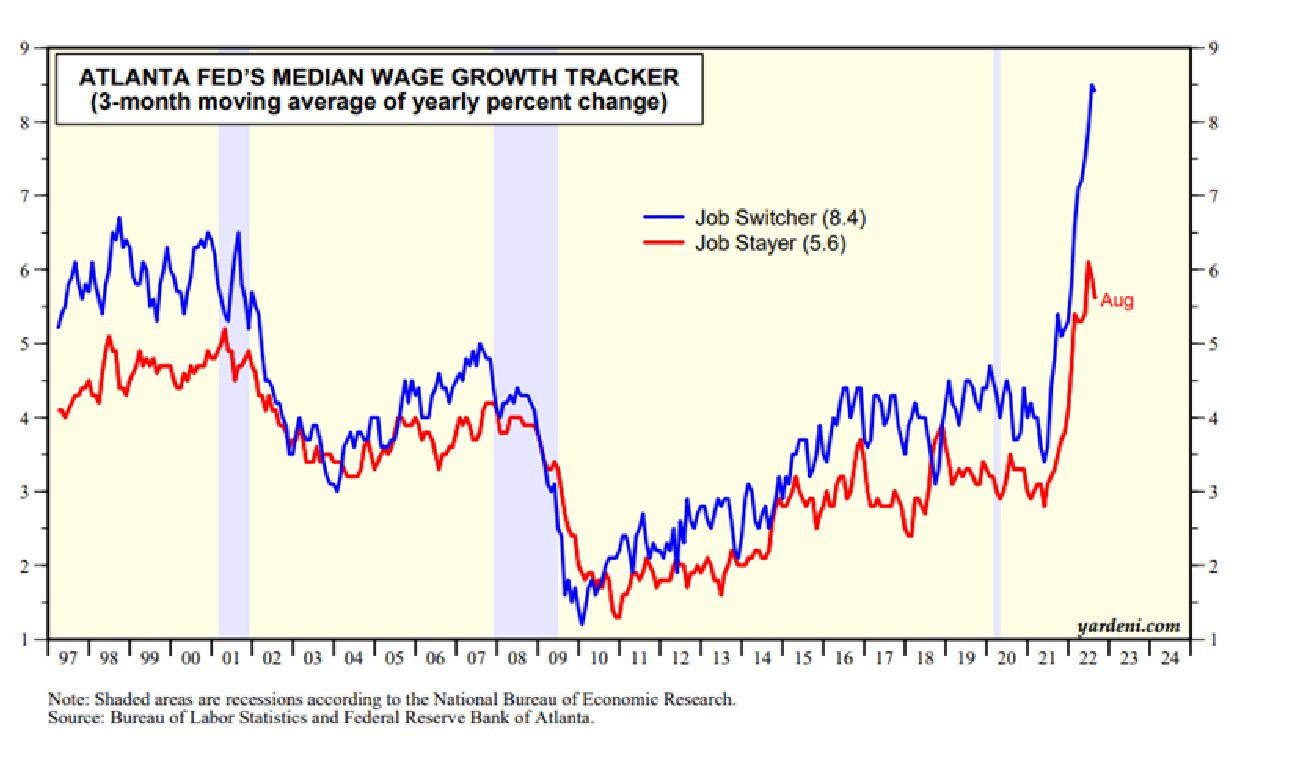

Overall wage growth has increased to 6.7% as of August 2022. Further, as the chart below illustrates, “job switchers” have enjoyed even higher wage growth increases of 8.4%. By beating the job market bushes in a tight labor market, job switchers have negotiated higher pay with their new employers.

Why is the Labor Market Tight?

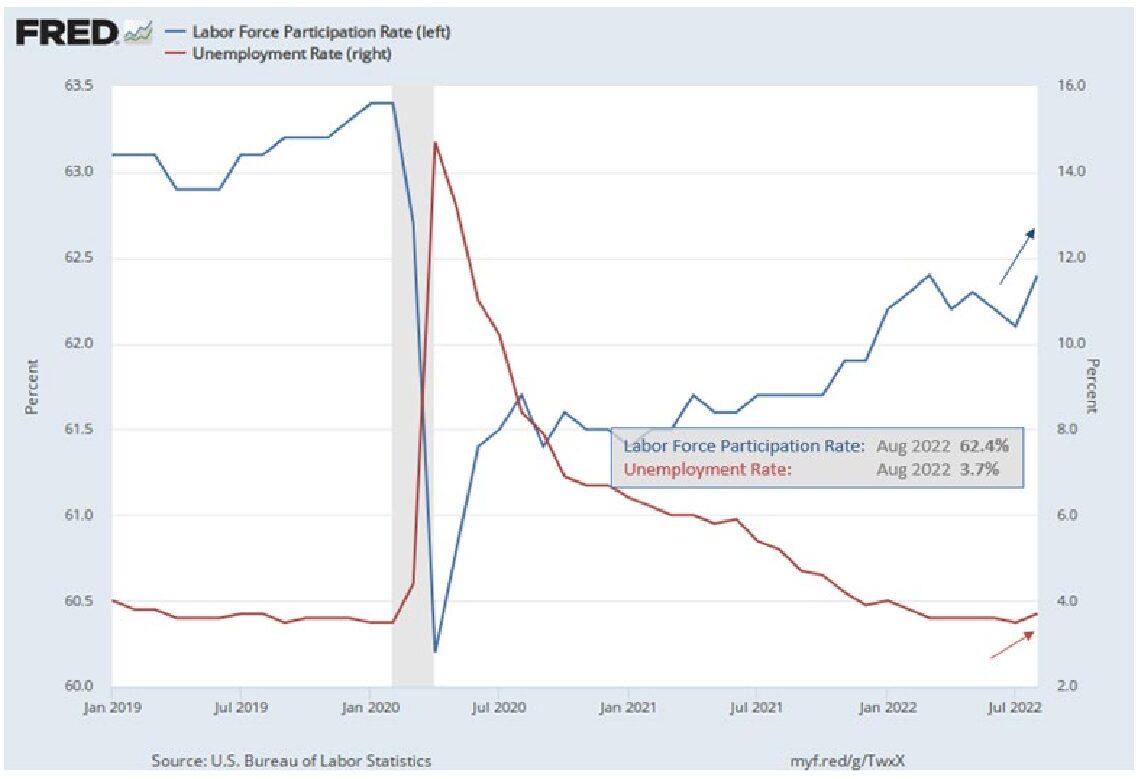

The unemployment rate continues to remain at historic lows, most recently measured at 3.7%. Simultaneously the labor force participation rate is also historically low constricting the supply of workers. Participation has steadily improved to 62.4% but is well below the 63.4% rate before the lockdowns. With less hands participating, jobs are plentiful which suppresses reported unemployment rates.

Two Birds for Every Hand

Ironically the Fed would like to see the unemployment rate increase preferably through a higher labor force participation rate. Simultaneously they would like to see demand for workers decrease.

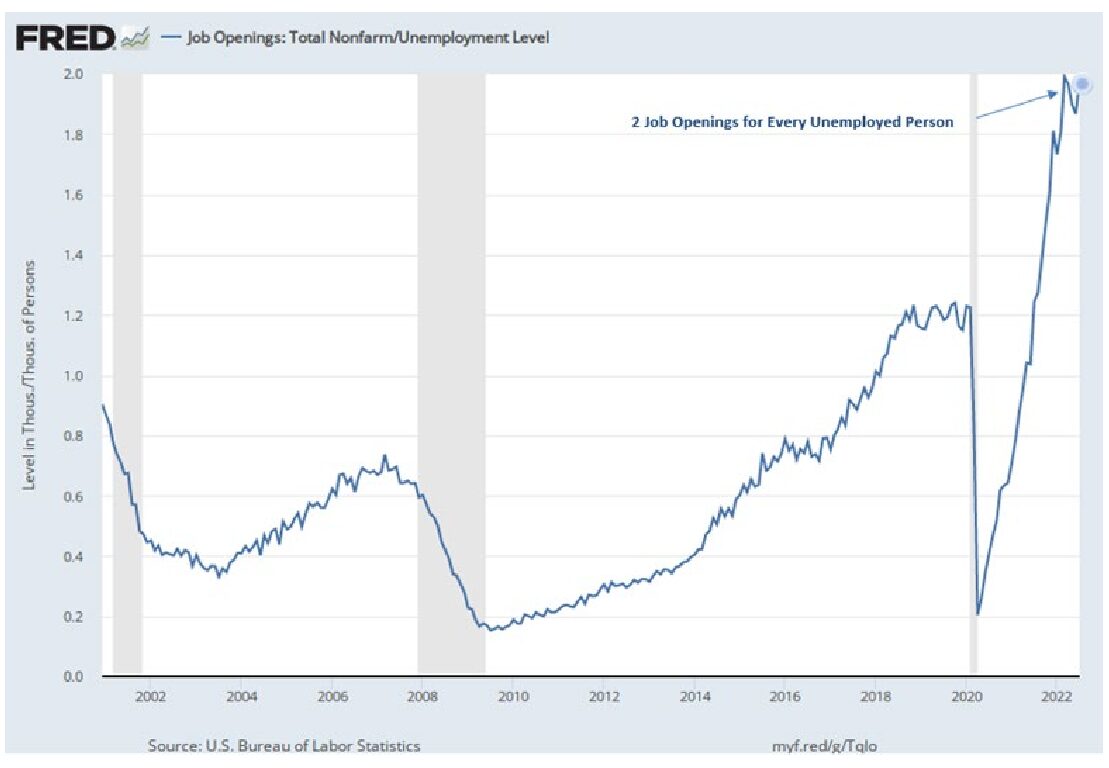

For every unemployed person there are two job openings reflecting the disconnect between the supply of and demand for labor.

By slowing economic growth, the policy makers are attempting to thin the flock of jobs available.

A continued imbalance between the supply and demand of workers increases the risk of a wage price spiral. The Federal Reserve is concerned such a spiral could threaten price stability pulling inflation higher, away from their long-term target rate of 2%. By engineering a slowdown in economic activity through tightening financial conditions, the policy makers are hopeful workers will return to the labor market and companies will pare back job openings. With a return to a balanced employment environment, Mr. Powell’s hope is that workers will appreciate the bird in their hand once again.

What does this mean for my financial goals?

Inflation impacts all aspects of your financial planning. Our team can help you make prudent decisions with your goals and needs in mind. Reach out to your adviser or connect with us if you have questions about your financial plan.[/vc_column_text][/vc_column][/vc_row]

2022 Employment Trends: How are Inflation and Labor Markets Related?

[vc_row css_animation=”” row_type=”row” use_row_as_full_screen_section=”no” type=”full_width” angled_section=”no” text_align=”left” background_image_as_pattern=”without_pattern”][vc_column][vc_column_text]

Posted By [post_author]

A bird in the hand is better than two in the bush. Today’s labor market has turned this proverb around and it has Jay Powell’s attention.

The financial markets have been in turmoil as the Federal Reserve has struggled to control inflation. The US central bank has acknowledged their initial error of judging inflation as “transitory” largely due to pandemic induced supply chain disruptions. While many of these issues are resolving, core inflation measurements have remained persistently elevated.

A major concern for policymakers has been the imbalance between labor supply and demand. But how are employment and inflation related? This month’s update will focus on a few of the employment trends and their contributions to the Fed’s challenge of containing inflation.

The Threat of a Wage Price Spiral

At his May 2022 press conference, Federal Reserve chairman Jay Powell stated, “Wages are rising at the fastest pace in many years… We can’t allow a wage-price spiral to happen.” Intuitively higher wages would seem to be a positive for US consumers. A wage price spiral can lead to lasting inflation through two mechanisms, creating a feedback loop between them.

Overall wage growth has increased to 6.7% as of August 2022. Further, as the chart below illustrates, “job switchers” have enjoyed even higher wage growth increases of 8.4%. By beating the job market bushes in a tight labor market, job switchers have negotiated higher pay with their new employers.

Why is the Labor Market Tight?

The unemployment rate continues to remain at historic lows, most recently measured at 3.7%. Simultaneously the labor force participation rate is also historically low constricting the supply of workers. Participation has steadily improved to 62.4% but is well below the 63.4% rate before the lockdowns. With less hands participating, jobs are plentiful which suppresses reported unemployment rates.

Two Birds for Every Hand

Ironically the Fed would like to see the unemployment rate increase preferably through a higher labor force participation rate. Simultaneously they would like to see demand for workers decrease.

For every unemployed person there are two job openings reflecting the disconnect between the supply of and demand for labor.

By slowing economic growth, the policy makers are attempting to thin the flock of jobs available.

A continued imbalance between the supply and demand of workers increases the risk of a wage price spiral. The Federal Reserve is concerned such a spiral could threaten price stability pulling inflation higher, away from their long-term target rate of 2%. By engineering a slowdown in economic activity through tightening financial conditions, the policy makers are hopeful workers will return to the labor market and companies will pare back job openings. With a return to a balanced employment environment, Mr. Powell’s hope is that workers will appreciate the bird in their hand once again.

What does this mean for my financial goals?

Inflation impacts all aspects of your financial planning. Our team can help you make prudent decisions with your goals and needs in mind. Reach out to your adviser or connect with us if you have questions about your financial plan.[/vc_column_text][/vc_column][/vc_row]

Related Posts

Q1 2024 Webinar Review

Despite recent market volatility, the markets are off to a positive start for the year, with the S&P 500 providing its best 1st quarter return since 2019. In our 2024

Q3 2023 Webinar Review

We hope everyone is enjoying the fall season. Below is the link to FAS Wealth Partners’ 3rd quarter of 2023 review featuring a special guest James Meyers, CFA. Mr. Meyers is a